利用者:ShuBraque/sandbox/総需要

Sometimes, especially in textbooks, "aggregate demand" refers to an entire demand curve that looks like that in a typical Marshallian supply and demand diagram.

Thus, that we could refer to an "aggregate quantity demanded" ( in real or inflation-corrected terms) at any given aggregate average price level (such as the GDP deflator), .

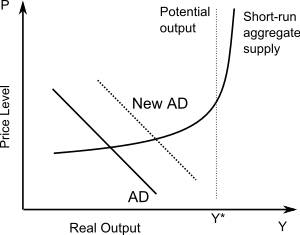

In these diagrams, typically the rises as the average price level () falls, as with the line in the diagram. The main theoretical reason for this is that if the nominal money supply (Ms) is constant, a falling implies that the real money supply ()rises, encouraging lower interest rates and higher spending. This is often called the "Keynes effect."

Carefully using ideas from the theory of supply and demand, aggregate supply can help determine the extent to which increases in aggregate demand lead to increases in real output or instead to increases in prices (inflation). In the diagram, an increase in any of the components of (at any given ) shifts the curve to the right. This increases both the level of real production () and the average price level ().

But different levels of economic activity imply different mixtures of output and price increases. As shown, with very low levels of real gross domestic product and thus large amounts of unemployed resources, most economists of the Keynesian school suggest that most of the change would be in the form of output and employment increases. As the economy gets close to potential output (), we would see more and more price increases rather than output increases as increases.

Beyond , this gets more intense, so that price increases dominate. Worse, output levels greater than cannot be sustained for long. The is a short-term relationship here. If the economy persists in operating above potential, the curve will shift to the left, making the increases in real output transitory.

At low levels of , the world is more complicated. First, most modern industrial economies experience few if any falls in prices. So the curve is unlikely to shift down or to the right. Second, when they do suffer price cuts (as in Japan), it can lead to disastrous deflation.

Debt

[編集]A Post-Keynesian theory of aggregate demand emphasizes the role of debt, which it considers a fundamental component of aggregate demand;[1] the contribution of change in debt to aggregate demand is referred to by some as the credit impulse.[2] Aggregate demand is spending, be it on consumption, investment, or other categories. Spending is related to income via:

- Income – Spending = Net Savings

Rearranging this yields:

- Spending = Income – Net Savings = Income + Net Increase in Debt

In words: what you spend is what you earn, plus what you borrow: if you spend $110 and earned $100, then you must have net borrowed $10; conversely if you spend $90 and earn $100, then you have net savings of $10, or have reduced debt by $10, for net change in debt of –$10.

If debt grows or shrinks slowly as a percentage of GDP, its impact on aggregate demand is small; conversely, if debt is significant, then changes in the dynamics of debt growth can have significant impact on aggregate demand. Change in debt is tied to the level of debt:[1] if the overall debt level is 10% of GDP and 1% of loans are not repaid, this impacts GDP by 1% of 10% = 0.1% of GDP, which is statistical noise. Conversely, if the debt level is 300% of GDP and 1% of loans are not repaid, this impacts GDP by 1% of 300% = 3% of GDP, which is significant: a change of this magnitude will generally cause a recession. Similarly, changes in the repayment rate (debtors paying down their debts) impact aggregate demand in proportion to the level of debt. Thus, as the level of debt in an economy grows, the economy becomes more sensitive to debt dynamics, and credit bubbles are of macroeconomic concern. Since write-offs and savings rates both spike in recessions, both of which result in shrinkage of credit, the resulting drop in aggregate demand can worsen and perpetuate the recession in a vicious cycle.

This perspective originates in, and is intimately tied to, the debt-deflation theory of Irving Fisher, and the notion of a credit bubble (credit being the flip side of debt), and has been elaborated in the Post-Keynesian school.[1] If the overall level of debt is rising each year, then aggregate demand exceeds Income by that amount. However, if the level of debt stops rising and instead starts falling (if "the bubble bursts"), then aggregate demand falls short of income, by the amount of net savings (largely in the form of debt repayment or debt writing off, such as in bankruptcy). This causes a sudden and sustained drop in aggregate demand, and this shock is argued to be the proximate cause of a class of economic crises, properly financial crises. Indeed, a fall in the level of debt is not necessary – even a slowing in the rate of debt growth causes a drop in aggregate demand (relative to the higher borrowing year).[3] These crises then end when credit starts growing again, either because most or all debts have been repaid or written off, or for other reasons as below.

From the perspective of debt, the Keynesian prescription of government deficit spending in the face of an economic crisis consists of the government net dis-saving (increasing its debt) to compensate for the shortfall in private debt: it replaces private debt with public debt. Other alternatives include seeking to restart the growth of private debt ("reflate the bubble"), or slow or stop its fall; and debt relief, which by lowering or eliminating debt stops credit from contracting (as it cannot fall below zero) and allows debt to either stabilize or grow – this has the further effect of redistributing wealth from creditors (who write off debts) to debtors (whose debts are relieved).

Criticisms

[編集]Austrian theorist Henry Hazlitt argued that aggregate demand is a meaningless concept in economic analysis.[4] Friedrich Hayek, another Austrian, argued that Keynes' study of the aggregate relations in an economy is fallacious, as recessions are caused by micro-economic factors.[5]

- ^ a b c Debtwatch No 41, December 2009: 4 Years of Calling the GFC, en:Steve Keen, December 1, 2009

- ^ Credit and Economic Recovery: Demystifying Phoenix Miracles, Michael Biggs, Thomas Mayer, Andreas Pick, March 15, 2010

- ^ "However much you borrow and spend this year, if it is less than last year, it means your spending will go into recession." Dhaval Joshi, RAB Capital, quoted in Noughty boys on trading floor led us into debt-laden fantasy

- ^ Hazlitt, Henry (1959). The Failure of the 'New Economics': An Analysis of the Keynesian Fallacies. D. Van Nostrand[要ページ番号]

- ^ Hayek, Friedrich (1989). The Collected Works of F.A. Hayek. University of Chicago Press. p. 202. ISBN 978-0-226-32097-7